UNITED STATES

SECURITIES AND EXCHANGE COMMISSIONWashington,

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to SectionPROXY STATEMENT PURSUANT TO SECTION 14(a) of the Securities Exchange Act ofOF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. __)

Filed by the Registrant ☐ Filed by a Party other than the Registrant ☐ |

|

|

|

|

Check the appropriate box:

| Preliminary Proxy Statement | |

|

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| ☒ | Definitive Proxy Statement |

|

| ☐ | Definitive Additional Materials |

|

| ☐ | Soliciting Material |

SG BLOCKS, INC.

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other thanOther Than the Registrant)

Payment of Filing Fee (Check(check the appropriate box):

| No fee required. | |||

| ||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) |

| Title of each class of securities to which transaction applies: | ||

| (2) |

| Aggregate number of securities to which transaction applies: | ||

| (3) |

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 | ||

| (4) |

| Proposed maximum aggregate value of transaction: | ||

| (5) |

| Total fee paid: | ||

| ☐ | ||||

| Fee paid previously with preliminary materials. | |||

| ||||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) |

| Amount Previously Paid: | ||

| (2) |

| Form, Schedule or Registration Statement No.: | ||

| (3) |

| Filing Party: | ||

| (4) |

| Date Filed: | ||

195 Montague Street, 14th14th Floor

Brooklyn, New York 11201

June 25, 2020

NOTICE OF ANNUAL MEETING OF STOCKHOLDERSTO BE HELD JUNE 1, 2018

To the Stockholders of SG Blocks, Inc.:

The 2018

We hereby notify you that the 2020 Annual Meeting of Stockholders (the “2020 Annual Meeting” or “Annual Meeting”) of SG Blocks, Inc., a Delaware corporation, (the “Company”), will be held on Friday, June 1, 2018,July 30, 2020 beginning at 9:10:00 a.m., local time be held at the offices of Thompson Hine LLP (“Thompson Hine”), 335 Madison Avenue, 12th Floor,200 Broadhollow Road, Melville, New York New York,11747, for the following purposes:

1. To elect seven

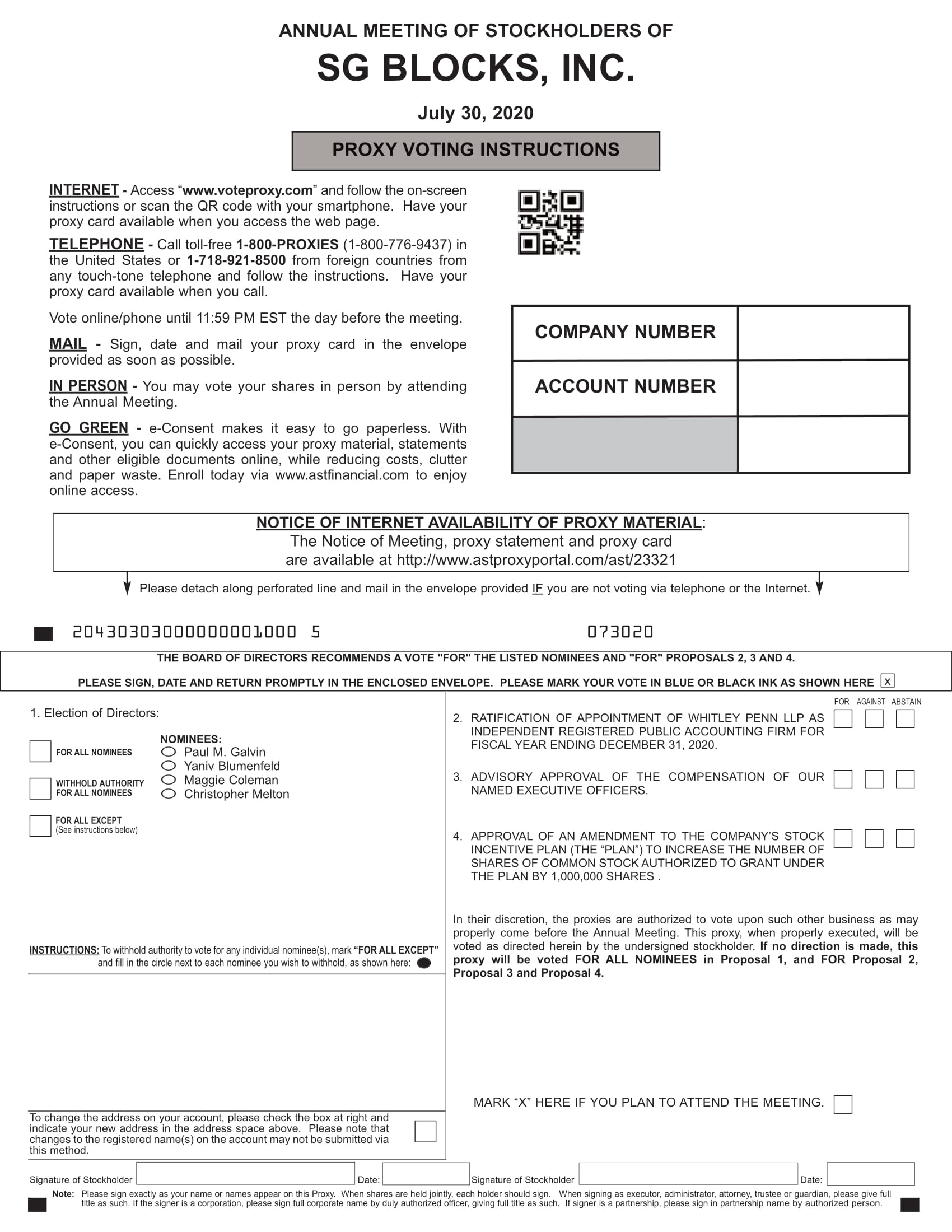

| 1. | to elect the four (4) directors named in the proxy statement to serve on our Board of Directors until the next annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| 2. | to consider and vote upon ratification of the appointment of Whitley Penn LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020; |

| 3. | to approve, on an advisory, non-binding basis, the compensation of our named executive officers (Say-on-Pay); |

| 4. | to approve an amendment to our Stock Incentive Plan (the “Plan”) to increase the number of shares of common stock that we will have authority to grant under the Plan by 1,000,000 shares; and |

| 5. | to transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The matters listed in this notice of meeting are described in detail in the accompanying proxy statement. Our Board of Directors until the next annual meeting of stockholders and until their respective successors are duly elected and qualified;

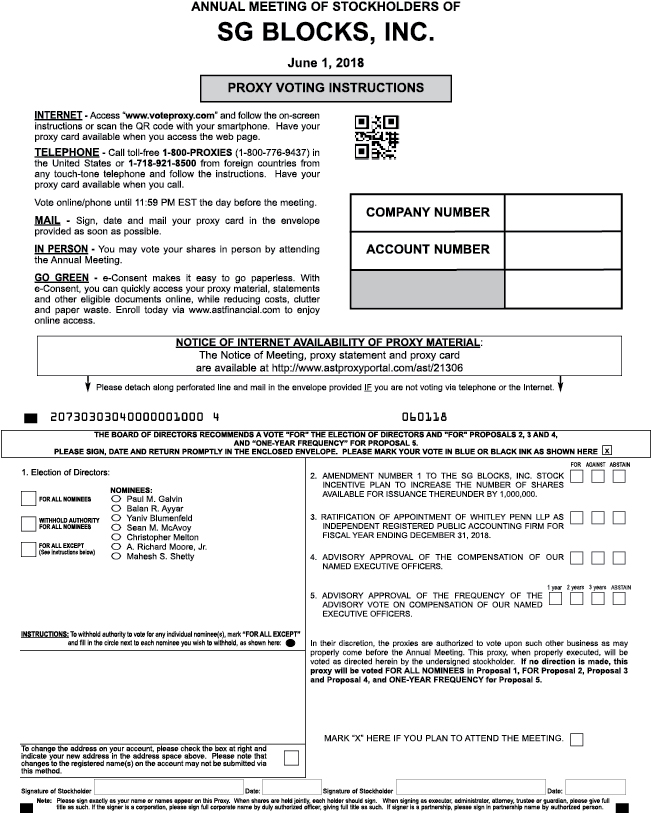

2. To consider and vote upon an amendment to the SG Blocks, Inc. Stock Incentive Plan to increase the number of shares available for issuance thereunder in the amount of 1,000,000 shares, from 1,500,000 to 2,500,000 shares;

3. To consider and vote upon ratification of the appointment of Whitley Penn LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018;

4. To approve, on an advisory, non-binding basis, the compensation of our named executive officers (Say-on-Pay);

5. To approve, on an advisory, non-binding basis, the frequency of the stockholder vote to approve the compensation of our named executive officers (Say-When-on-Pay); and

6. To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Only stockholders of record athas fixed the close of business on April 12, 2018June 22, 2020 as the record date for determining those stockholders who are entitled to notice of and to vote at the meeting or any adjournment or postponement of our 2020 Annual Meeting and at any adjournments or postponementsMeeting. The list of the Annual Meeting. A liststockholders of stockholders entitled to voterecord as of the close of business on June 22, 2020 will be made available for inspection at the meeting will be availableand at our principal place of business for inspection by stockholders, for any purpose germane to the meeting, at the Annual Meeting and during normal business hours during the ten-day period immediatelyten days prior to the 2020 Annual Meeting, at our principal executive offices at 195 Montague Street, 14th Floor, Brooklyn, New York 11201.Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. If you plan to attend the Annual Meeting, prior to June 1, 2018, you must inform the Company’s outside counsel, via e-mail at NYC-Reception@thompsonhine.com or by telephone at 212-692-3500, of your intent to attend the Annual Meeting. To gain access to the offices of Thompson Hine, you must present a form of picture identification to the security officer at the desk located on the main floor of 335 Madison Avenue. You will be provided a pass to permit access to the building’s elevators and will proceed to the 12th floor offices of Thompson Hine.IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 30, 2020.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on June 1, 2018:In accordance with the rules of the Securities and Exchange Commission (the “SEC”), we are advising our stockholders of Internet availability of our proxy materials related to the 2020 Annual Meeting. SEC rules allow companies to provide access to proxy materials in one of two ways. Because we have elected to use the “full set delivery” option, we are delivering our proxy materials to our stockholders by providing paper copies, as well as providing access to our proxy materials on a publicly accessible website. Our proxy statement, proxy card Annual Report on Form 10-K for the year ended December 31, 2017 and this notice are available atwww.sgblocks.com orwww.astproxyportal.com/ast/2130623321..

You can vote by proxy over the Internet by following the instructions provided in the proxy materials that were mailed to you onOn or about April 20, 2018, or you can vote by mail or by telephone. Your promptness in voting byJune 30, 2020, we will begin mailing this proxy will assist in its expeditious and orderly processing and will ensure that you are represented at the Annual Meeting. Proxies are being solicited on behalf of the Board. If you vote by proxy, you may nevertheless attend the Annual Meeting and vote your shares in person.statement.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE SUBMIT A PROXY AS PROMPTLY AS POSSIBLE BY USING THE INTERNET OR THE DESIGNATED TOLL-FREE TELEPHONE NUMBER, OR BY SIGNING, DATING AND RETURNING BY MAIL THE PROXY CARD IN THE RETURN ENVELOPE PROVIDED.

By | ||

/s/ Paul M. Galvin | ||

Paul M. Galvin,

|

195 Montague Street, 14th Floor

Brooklyn, New York 11201

April 19, 2018

TO ENSURE YOUR REPRESENTATION AT THE MEETING, YOU ARE URGED TO READ THIS PROXY STATEMENT AND SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE BY FOLLOWING THE INSTRUCTIONS IN THE PROXY MATERIALS, WHICH WERE MAILED TO YOU ON OR ABOUT APRIL 20, 2018. YOU MAY VOTE ONLINE, BY TELEPHONE OR BY MAILING YOUR SIGNED PROXY CARD IN THE ENCLOSED RETURN ENVELOPE.

Table Of ContentsFor the 2020 Annual Meeting of Stockholders to be held on July 30, 2020

|

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

i

SG BLOCKS, INC.GENERAL INFORMATION

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERSTO BE HELD ON JUNE 1, 2018

This

We are providing these proxy statement is being furnishedmaterials to youholders of shares of common stock, $0.01 par value per share (“Common Stock”), of SG Blocks, Inc., a Delaware corporation (referred to as “SG Blocks,” the “Company,” “we,” or “us”), in connection with the solicitation of proxies by the Board of Directors (the “Board”) of SG Blocks Inc. (the “Company,” “we,” “us”“Board” or “our”“Board of Directors”). The 2018 of proxies to be voted at our 2020 Annual Meeting of Stockholders (the “2020 Annual Meeting” or “Annual Meeting”) willto be held at 200 Broadhollow Road, Melville, New York 11747, on Friday, June 1, 2018,July 30, 2020, beginning at 9:10:00 a.m., local time, and at the officesany adjournment or postponement of Thompson Hine LLP (“Thompson Hine”), 335 Madison Avenue, 12th Floor, New York, New York 10017. The Company’s telephone number is (646) 240-4235.our 2020 Annual Meeting.

ABOUT THE ANNUAL MEETING

What is the purpose of the Annual Meeting?

The purpose of the 2020 Annual Meeting and the matters to be acted uponon are set forth understated in the headingsProposal 1 — Election of Directors,Proposal 2 — Amendment to the SG Blocks, Inc. Stock Incentive Plan,Proposal 3 — Ratification of Appointment of Independent Registered Public Accounting Firm, Proposal 4 — Advisory Approval of Named Executive Officer Compensation andProposal 5 — Advisory Approval of the Frequency of the Advisory Vote on Named Executive Officer Compensation below and in theaccompanying Notice of Annual MeetingMeeting. The Board of Stockholders. You are requested to promptly vote by proxy by followingDirectors knows of no other business that will come before the instructions provided on the proxy card, which was mailed to you on or about April 20, 2018. You may vote online, by telephone or by mailing your signed proxy card in the enclosed return envelope.

How is the Company distributing the proxy materials?

The rules of the Securities and Exchange Commission (the “SEC”) permit us to make our proxy materials available in one of two ways: the “full set delivery” option or the “notice only” option. A company may use a single method for all of its stockholders or may use both methods. We have elected to use the full set delivery option to deliver the proxy materials for the Annual Meeting to each stockholder of record as of the Record Date (as defined below). As such, on or about April 20, 2018, we will be mailing paper copies of our proxy materials to stockholders, as well as providing access to the proxy materials atwww.sgblocks.com orwww.astproxyportal.com/ast/21306. We may decide not to use the full set delivery option in the future; however, you will still have the right to request a free set of proxy materials by mail.

Who may vote at and attend the Annual Meeting?

You are entitled to notice of the Annual Meeting and to vote, in person or by proxy, at the Annual Meeting if you owned shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), as of the close of business on April 12, 2018, which has been fixed as the record date (the “Record Date”) for the2020 Annual Meeting.

On the Record Date, 4,260,041 shares of Common Stock were issued and outstanding, held by 121 holders of record. Holders of record of our Common Stock are entitled to one vote per share.

All stockholders as of the Record Date, or their duly appointed proxies, may attend the Annual Meeting. If you attend the Annual Meeting in person, you will be asked to present photo identification (such as a state-issued driver’s license) and proof of your ownership of shares of Common Stock before entering the meeting. Please note that if you hold shares in “street name” (through a bank or broker, for example), you will need to bring a recent brokerage statement or a letter from your broker or bank reflecting your ownership of our Common Stock as of the Record Date. If you want to vote shares you hold in street name in person at the Annual Meeting, you must bring a legal proxy in your name from the broker, bank or other nominee that holds your shares.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of our Common Stock issued and outstanding and entitled to vote as of the Record Date will constitute a quorum. As of the Record Date, 2,130,021 shares of Common Stock constituted a majority. Broker “non-votes” (as described below), abstentions and

1

proxies marked “withhold” for the election of directors will be counted for purposes of determining the presence or absence of a quorum for the transaction of business.

What are broker “non-votes”?

If you hold your shares through a broker, your broker’s ability to vote your shares for you is governed by applicable stock exchange rules. Without your specific instruction, a broker or other nominee may only vote your shares on routine proposals. Your broker will submit a proxy card on your behalf, but leave your shares unvoted on non-routine proposals—this is known as a “broker non-vote.” Without your specific instruction, your broker will not vote your shares onProposal 1 — Election of Directors,Proposal 2 — Amendment to the SG Blocks, Inc. Stock Incentive Plan,Proposal 4 — Advisory Approval of Named Executive Officer Compensation orProposal 5 — Advisory Approval of the Frequency of the Advisory Vote on Named Executive Officer Compensation, which are considered “non-routine” proposals under applicable stock exchange rules. Non-votes will not be counted “FOR” or “AGAINST” these proposals.Proposal 3 — Ratification of Appointment of Independent Registered Public Accounting Firm is a routine matter on which your broker will vote without your instruction. Therefore, broker non-votes are not expected to occur with respect to Proposal 3.

How will abstentions be counted?

Generally, choosing to “ABSTAIN” from a vote is counted as a vote “AGAINST” a particular proposal. However, a vote to “ABSTAIN” from the election of any director (as in Proposal 1 of this proxy statement) will not be counted as a “FOR” or “AGAINST” vote. Even if you choose to “ABSTAIN” on any or every proposal, your shares will still be counted toward the quorum.

What vote is required to approve each proposal?

ForProposal 1 — Election of Directors, the nominees for director who receive the most votes cast (also known as a plurality), either in person or by proxy, will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one of the nominees. Votes that are withheld will not be included in the vote tally for, and will have no effect on, the election of directors. Broker non-votes, if any, will not be counted as having been voted and will have no effect on the election of directors, except to the extent the failure to vote for a nominee results in another nominee receiving a larger number of votes.

Adoption ofProposal 2 — Amendment to the SG Blocks, Inc. Stock Incentive Plan,Proposal 3 — Ratification of Appointment of Independent Registered Public Accounting Firm andProposal 4 — Advisory Approval of Named Executive Officer Compensation requires the affirmative vote of a majority of the total number of shares present in person or represented by proxy at the meeting and entitled to vote for each of these proposals. In determining whether Proposals No. 2, No. 3 and No. 4 have received the requisite number of affirmative votes, abstentions will be counted and will have the same effect as a vote against the proposals, and broker non-votes, if any, will have no effect on the votes for the proposals.

With respect toProposal 5 — Advisory Approval of the Frequency of the Advisory Vote on Named Executive Officer Compensation, the frequency (one year, two years or three years) that receives the highest number of votes cast by the stockholders will be deemed the frequency for the advisory approval of named executive officer compensation preferred by the stockholders. The proxy card provides stockholders with the opportunity to choose among four options (holding the vote every one, two or three years, or abstaining) and, therefore, stockholders will not be voting to approve or disapprove the recommendation of the Board. Abstentions and broker non-votes will have no effect on the results of this vote.

How do I vote?

To ensure your shares are voted at the meeting, you are urged to provide your proxy instructions promptly online, by telephone or by mailing your signed proxy card in the enclosed envelope. Please refer to the instructions on the proxy card. Authorizing your proxy will not limit your right to attend the Annual Meeting and vote your shares in person.

2

Your proxy (one of the individuals named in your proxy card) will vote your shares per your instructions. If you fail to provide instructions on a properly submitted proxy, your proxy will vote as recommended by the Board, as described below.

If you have shares held by a broker or other nominee, you may instruct your broker or nominee to vote your shares by following the instructions that the broker or nominee provides to you. Most brokers and nominees allow you to vote by mail, telephone and on the Internet. As discussed above, under applicable stock exchange rules,Proposal 1 — Election of Directors,Proposal 2 — Amendment to the SG Blocks, Inc. Stock Incentive Plan,Proposal 4 — Advisory Approval of Named Executive Officer Compensation andProposal 5 — Advisory Approval of the Frequency of the Advisory Vote on Named Executive Officer Compensation are “non-routine” matters, meaning that brokers or other nominees who have not been furnished voting instructions by their clients will not be authorized to vote in their discretion on those proposals.Proposal 3 — Ratification of Appointment of Independent Registered Public Accounting Firm is considered a “routine” matter, which means brokers or nominees who have not been furnished voting instructions by their clients will be authorized to vote on that proposal.

May I change my vote?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may revoke your proxy by attending the Annual Meeting and voting in person or by delivering to our Corporate Secretary a duly executed revocation of proxy or a new proxy bearing a later date. Attendance at the Annual Meeting will not itself constitute a revocation of a proxy.

How does the Board recommend I vote?

If you do not provide instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board.

The Board unanimously recommends a vote “of Directors is soliciting votes (1)FOR”:

• election to our Board of each of the seven directorfour (4) nominees named in this proxy statement;

• approval of the amendment (the “Amendment”)herein for election to the SG Blocks, Inc. Stock Incentive Plan (the “Incentive Plan”) to increaseBoard of Directors; (2)FOR the number of shares authorized for issuance;

• ratification of the appointment of WhitleyWhitney Penn, LLP (“WhitleyWhitney Penn”) as our independent registered public accounting firm for theour fiscal year ending on December 31, 2018;

•2020; (3) FOR the approval of on an advisory, non-binding basis, of the compensation of our named executive officers;officers (Say-on-Pay); and

• (4)FOR the approval on an advisory, non-binding basis, of an annual frequency foramendment to our Stock Incentive Plan to increase the vote onnumber of shares of common stock that we will have authority to grant under the compensationPlan by an additional 1,000,000 shares of our named executive officers.common stock.

We do not expect that any other matters will be presented for consideration at

ANNUAL MEETING ADMISSION

All stockholders as of the record date are welcome to attend the 2020 Annual Meeting. If however, anyyou attend, please note that you will be asked to present government-issued identification (such as a driver’s license or passport) and evidence of your share ownership of our common stock on the record date. This can be your proxy card if you are a stockholder of record. If your shares are held beneficially in the name of a bank, broker or other matters are properly presented,holder of record and you plan to attend the persons named2020 Annual Meeting, you will also be required to present proof of your ownership of our common stock on the record date, such as proxies intenda bank or brokerage account statement or voting instruction card, to vote on such matters in accordance with their judgment, including any proposalbe admitted to adjourn or postpone the 2020 Annual Meeting.

Who pays for expenses incurred in connection with the solicitation of proxies?

We are making this solicitation of proxies and have paid the entire expense of preparing, printing and mailing the proxy materials furnished to stockholders. The solicitation of proxiesNo cameras, recording equipment or electronic devices will be largely by mail, but our directors, officers or other representatives may solicit proxies from stockholders by telephone, e-mail or other electronic means, orpermitted in person. These persons will not receive additional compensation for soliciting proxies. Arrangements also will be made with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation materials2020 Annual Meeting.

Information on how to obtain directions to attend the beneficial owners of stock held of record by these persons, and we will reimburse them for reasonable out-of-pocket expenses.2020 Annual Meeting is available at:www.sgblocks.com.

1

INFORMATION ABOUT THE ANNUAL MEETING

| Q: | What information is contained in the proxy statement? |

| A: | The information included in this proxy statement relates to the proposals to be voted on at the 2020 Annual Meeting, the voting process and other required information. |

| Q: | How is the Company distributing the proxy materials? |

| A: | The rules of the Securities and Exchange Commission (the “SEC”) permit us to make our proxy materials available in one of two ways: the “full set delivery” option or the “notice only” option. A company may use a single method for all of its stockholders or may use both methods. We have elected to use the full set delivery option to deliver the proxy materials for the 2020 Annual Meeting to each stockholder of record as of the Record Date (as defined below). As such, on or about June 30, 2020, we will be mailing paper copies of our proxy materials to stockholders, as well as providing access to the proxy materials at www.sgblocks.com or www.astproxyportal.com/ast/23321. We may decide not to use the full set delivery option in the future; however, you will still have the right to request a free set of proxy materials by mail. |

| Q: | What items of business will be voted on at the 2020 Annual Meeting? |

| A: | The purpose of the 2020 Annual Meeting and matters to be acted upon are as follows: |

| 1. | to elect the four (4) directors named in the proxy statement to serve on our Board of Directors until the next annual meeting of stockholders and until their respective successors are duly elected and qualified; | |

| 2. | to consider and vote upon ratification of the appointment of Whitley Penn LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020; | |

| 3. | to approve, on an advisory, non-binding basis, the compensation of our named executive officers (Say-on-Pay); | |

| 4. | to approve an amendment to our Stock Incentive Plan to increase the number of shares of common stock that we will have authority to grant under the Plan by 1,000,000 shares; and | |

| 5. | to transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

| Q: | How does the Board of Directors recommend that I vote? |

| A: | The Board of Directors recommends that you vote your shares (1)FOR each of the four (4) nominees named herein for election to the Board of Directors; (2)FOR the ratification of the appointment of Whitney Penn, LLP (“Whitney Penn”) as our independent registered public accounting firm for our fiscal year ending on December 31, 2020; (3)FOR the approval of on an advisory, non-binding basis, the compensation of our named executive officers (Say-on-Pay); and (4)FOR the approval of an amendment to our Stock Incentive Plan to increase the number of shares of common stock that we will have authority to grant under the Plan by an additional 1,000,000 shares of common stock. We do not expect that any other matters will be presented for consideration at the 2020 Annual Meeting. If, however, any other matters are properly presented, the persons named as proxies intend to vote on such matters in accordance with their judgment, including any proposal to adjourn or postpone the 2020 Annual Meeting. |

| Q: | Who may vote at and attend the 2020 Annual Meeting? |

| A: | You are entitled to notice of the 2020 Annual Meeting and to vote, in person or by proxy, at the 2020 Annual Meeting if you owned shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), as of the close of business on June 22, 2020, which has been fixed as the record date (the “Record Date”) for the 2020 Annual Meeting. On the Record Date, 8,596,189 shares of Common Stock were issued and outstanding, held by 84 holders of record. Holders of record of our Common Stock are entitled to one vote per share. All stockholders as of the Record Date, or their duly appointed proxies, may attend the 2020 Annual Meeting. If you attend the Annual Meeting in person, you will be asked to present photo identification (such as a state-issued driver’s license) and proof of your ownership of shares of Common Stock before entering the meeting. Please note that if you hold shares in “street name” (through a bank or broker, for example), you will need to bring a recent brokerage statement or a letter from your broker or bank reflecting your ownership of our Common Stock as of the Record Date. If you want to vote shares you hold in street name in person at the 2020 Annual Meeting, you must bring a legal proxy in your name from the broker, bank or other nominee that holds your shares. |

2

| Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

| A: | Most of our stockholders hold their shares through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

Record Holder. If your shares are registered directly in your name on the books of SG Blocks maintained with SG Blocks’ transfer agent, American Stock Transfer & Trust Company, you are considered the “record holder” of those shares, and the proxy statement is sent directly to you by SG Blocks. As the stockholder of record, you have the right to grant a proxy to someone to vote your shares or to vote in person at the 2020 Annual Meeting. To ensure your shares are voted at the 2020 Annual Meeting, you are urged to provide your proxy instructions promptly online or by mailing your signed proxy card in the envelope provided. Please refer to the instructions on the proxy card. Authorizing your proxy will not limit your right to attend the 2020 Annual Meeting and vote your shares in person. | |

| Beneficial Owner of Shares Held in Street Name. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in street name (also called a “street name” holder), and the proxy statement is forwarded to you by your broker, bank or other nominee. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in your account. However, since you are not a stockholder of record, you may not vote these shares in person at the 2020 Annual Meeting unless you bring with you a legal proxy from the stockholder of record. A legal proxy may be obtained from your broker, bank or nominee. | |

| If you hold your shares through a broker and you do not give instructions to the record holder on how to vote, the record holder will be entitled to vote your shares in its discretion on certain matters considered routine, such as the ratification of the appointment of independent auditors. The uncontested election of directors, the approval, on an advisory and non-binding basis, of the compensation of our named executive officers and the approval of the amendment to the Stock Incentive Plan are not considered routine matters. Therefore, brokers do not have the discretion to vote on those proposals. If you hold your shares in street name and you do not instruct your broker how to vote in these matters not considered routine, no votes will be cast on your behalf and your broker will submit a proxy card on your behalf, but leave your shares unvoted on non-routine proposals — this is known as a “broker non-vote.”These “broker non-votes” will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but not as shares entitled to vote on a particular proposal. Without specific instructions, your broker will not vote on the election of directors, the approval, on an advisory and non-binding basis, of the compensation of our named executive officers and the approval of the amendment to the Stock Incentive Plan. Theratification of the appointment of independent auditors is a routine matter on which your broker will vote without your instruction and therefore, broker non-votes are not expected to occur with respect to theratification of the appointment of independent auditors. Broker non-votes will still be counted toward the quorum. | |

| Q: | Can I change my vote or revoke my proxy? |

| A: | You may change your vote or revoke your proxy at any time before the final vote at the 2020 Annual Meeting. To change your vote or revoke your proxy if you are the record holder, you may (1) notify our Corporate Secretary in writing at SG Blocks, Inc., 195 Montague Street, 14th Floor, Brooklyn, New York 11201; (2) submit a later-dated proxy (either by mail or internet), subject to the voting deadlines that are described on the proxy card or voting instruction form, as applicable; (3) deliver to our Corporate Secretary another duly executed proxy bearing a later date; or (4) by attending the 2020 Annual Meeting in person and voting your shares during such time. Attending the 2020 Annual Meeting will not, by itself, revoke a proxy unless you specifically so request. For shares you hold beneficially, you may change your vote by submitting new voting instructions to your broker or nominee or, if you have obtained a valid proxy from your broker or nominee giving you the right to vote your shares, by attending the 2020 Annual Meeting in person and voting your shares during such time. |

3

Q: | Who can help answer my questions? |

| A: | If you have any questions about the 2020 Annual Meeting or how to vote or revoke your proxy, or you need additional copies of this proxy statement or voting materials, you should contact the Corporate Secretary, SG Blocks, Inc., at 195 Montague Street, 14th Floor, Brooklyn, New York 11201 or by phone at (646) 240-4235. |

| Q: | How are votes counted? |

| A: | In the election of directors, you may vote FOR all of the four (4) nominees named herein or you may direct your vote to be WITHHELD with respect to any one or more of the four nominees. With respect to Proposals 2-4, you may vote FOR, AGAINST, or ABSTAIN.On these proposals, if you ABSTAIN, it has the same effect as a vote AGAINST. |

| If you provide specific instructions on your proxy card, your shares will be voted as you instruct. If you are a record holder and you sign your proxy card or voting instruction card with no further instructions, your shares will be voted in accordance with the recommendations of the Board of Directors, namely (1)FOR each of the four (4) nominees named herein for election to the Board of Directors; (2)FOR the ratification of the appointment of Whitney Penn, LLP (“Whitney Penn”) as our independent registered public accounting firm for our fiscal year ending on December 31, 2020; (3)FOR the approval, on an advisory, non-binding basis, the compensation of our named executive officers (Say-on-Pay); and (4)FOR the approval of an amendment to our Stock Incentive Plan to increase the number of shares of Common Stock that we will have authority to grant under the Plan by an additional 1,000,000 shares of common stock. | |

| Q: | What is a quorum and why is it necessary? |

| A: | Conducting business at the meeting requires a quorum. The presence, either in person or by proxy, of the holders of a majority of our shares of Common Stock issued and outstanding and entitled to vote on the record date present in person or represented by proxy is necessary to constitute a quorum. Abstentions and proxies marked “withhold” for the election of directors are treated as present for purposes of determining whether a quorum exists. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the 2020 Annual Meeting. Broker non-votes (as described below) are treated as present for purposes of determining whether a quorum is present at the meeting. |

| Q: | What is the voting requirement to approve each of the proposals? |

| A: | For Proposal 1 (the election of directors), the four (4) persons named herein receiving the highest number of FOR votes cast at the 2020 Annual Meeting (from the holders of votes of shares present in person or represented by proxy at the 2020 Annual Meeting and entitled to vote on the election of directors) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one of the nominees. Only votes FOR or WITHHELD will affect the outcome. Abstentions and broker non-votes, if any, will have no effect on the outcome of the vote as long as each nominee receives at least one FOR vote. You do not have the right to cumulate your votes. |

| To be approved, Proposal 2, which relates to the ratification of the appointment of Whitney Penn, as our independent registered public accounting firm for the year ending December 31, 2020, must receive FOR votes from the holders of a majority of the shares present in person or represented by proxy at the 2020 Annual Meeting and entitled to vote on the matter. Abstentions will have the same effect as an AGAINST vote and broker-non votes, if any, will have no effect on the votes for this proposal. Although none are expected to exist in connection with Proposal 2 since this is a routine matter for which brokers have discretion to vote if beneficial owners do not provide voting instructions, broker non-votes, if any, will have no effect. | |

To be approved, Proposal 3, which relates to the approval, on an advisory, non-binding basis, of the compensation of our named executive officers(Say-on-Pay), must receive FOR votes from the holders of a majority of the shares present in person or represented by proxy and entitled to vote on the matter. Abstentions will have the same effect as an AGAINST vote. Broker non-votes will have no effect. This vote is advisory, and therefore is not binding on us, the Compensation Committee or the Board of Directors. The Board of Directors and Compensation Committee value the opinions of our stockholders and to the extent there is any significant vote against the named executive officers’ compensation as disclosed in this proxy statement, we will consider our stockholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns. |

4

To be approved, Proposal 4, which relates to the approval of an increase in the number of shares of Common Stock that may be granted under our Stock Incentive Plan, must receive FOR votes from the holders of a majority of the votes present in person or represented by proxy and entitled to vote on the matter. Abstentions will have the same effect as an AGAINST vote.Broker non-votes will have no effect. If your shares are held in “street name” and you do not indicate how you wish to vote, your broker is permitted to exercise its discretion to vote your shares on certain “routine” matters. The only routine matter to be submitted to our stockholders at the 2020 Annual Meeting is Proposal 2. Each of Proposals 1, 3 and 4 are not routine matters. Accordingly, if you do not direct your broker how to vote for a director in Proposal 1, 3 or 4, your broker may not exercise discretion and may not vote your shares on that proposal. For purposes of Proposals 1, 3 and 4, broker non-votes are not “entitled to vote” at the meeting unless otherwise instructed. As such, a broker non-vote will not be counted as a vote FOR or WITHHELD with respect to a director in Proposal 1, or a vote FOR or AGAINST with respect to Proposal 3 or Proposal 4; and, therefore, will have no effect on the outcome of the vote for these Proposals. Abstentions will be counted in determining the total number of “votes cast” and the total number of shares present in person or represented by proxy and entitled to vote on each of the proposals and will therefore have the effect of a vote AGAINST on each proposal, except for Proposal 1, where the abstention will have no effect on the outcome of the vote. | |

| We encourage you to voteFOR all four (4) proposals. | |

| Q: | What should I do if I receive more than one proxy statement? |

| A: | You may receive more than one proxy statement. For example, if you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy statement. Please follow the voting instructions on all of the proxy statements to ensure that all of your shares are voted. |

| Q: | Where can I find the voting results of the 2020 Annual Meeting? |

| A: | We intend to announce preliminary voting results at the 2020 Annual Meeting and publish final results in a Current Report on Form 8-K, which we expect will be filed within four (4) business days of the 2020 Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four (4) business days after the 2020 Annual Meeting, we intend to file a Current Report on Form 8-K to publish results as to matters for which we have final votes and, within four (4) business days after the final results are known to us, file an additional Current Report on Form 8-K to publish the final results. |

| Q: | What happens if additional matters are presented at the 2020 Annual Meeting? |

| A: | Other than the four (4) items of business described in this proxy statement, we are not aware of any other business to be acted upon at the 2020 Annual Meeting. If you grant a proxy, the persons named as proxy holders, Mr. Paul Galvin, our Chief Executive Officer, and Mr. Gerald Sheeran, our Acting Chief Financial Officer, or either of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. |

| Q: | How many shares are outstanding and how many votes is each share entitled? |

| A: | Each share of our Common Stock that is issued and outstanding as of the close of business on June 22, 2020, the Record Date, is entitled to be voted on all items being voted on at the 2020 Annual Meeting, with each share being entitled to one vote on each matter. As of the Record Date, June 22, 2020, 8,596,189 shares of Common Stock were issued and outstanding. |

| Q: | Who will count the votes? |

| A: | One or more inspectors of election will tabulate the votes. |

| Q: | Is my vote confidential? |

| A: | Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed, either within SG Blocks or to anyone else, except: (1) as necessary to meet applicable legal requirements; (2) to allow for the tabulation of votes and certification of the vote; or (3) to facilitate a successful proxy solicitation. |

| Q: | Who will bear the cost of soliciting votes for the 2020 Annual Meeting? |

| A: | The Board of Directors is making this solicitation on behalf of SG Blocks, which will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials. Certain of our directors, officers, and employees, without any additional compensation, may also solicit your vote in person, by telephone or by electronic communication. On request, we will reimburse brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders. In addition to the use of the mail, proxies may be solicited by personal interview, telephone, telegram, facsimile and advertisement in periodicals and postings, in each case by our directors, officers and employees without additional compensation. Brokerage houses, nominees, fiduciaries and other custodians will be requested to forward solicitation materials to beneficial owners and will be reimbursed for their reasonable expenses incurred in so doing. We may request by telephone, facsimile, mail, electronic mail or other means of communication the return of the proxy cards. |

5

PROPOSAL 1 — ELECTION OF DIRECTORS

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE YOUR SHARES FOR THE ELECTION

OF EACH OF THESE NOMINEES

Currently, the Board of Directors consists of five (5) members and may be changed by resolution of the Board of Directors. At the 2020 Annual Meeting, sevenfour (4) nominees will be elected as directors. OurThree of the current members: Paul Galvin (Chairman of the Board), Christopher Melton (Lead Independent Director) and Yaniv Blumenfeld have been nominated by the Nominating and Corporate Governance Committee and the Board currently consists of eight members. Neal Kaufman, who is currently a memberDirectors of SG Blocks for election as directors of SG Blocks at the 2020 Annual Meeting. In addition, Maggie Coleman has been nominated by the Nominating and Corporate Governance Committee of the Board will not standof Directors of SG Blocks for re-election, and his term will expireelection as a director of SG Blocks at the Annual Meeting. Mr. Kaufman has decided not to stand for re-election in order to focus on his other business and personal interests. Pursuant to our bylaws, which permit the Board to set the number of directors from time to time and to appoint directors between annual meetings, and resolutions adopted by the Board, the size of our Board will be reduced from eight to seven members, effective immediately after the2020 Annual Meeting. The sevenBoard of Directors believes that it is in the best interests of SG Blocks to elect the above-described nominees, are named below. Proxies cannot be voted foreach to serve as a greater numberdirector until the next annual meeting of persons thanstockholders and until his/her successor shall have been duly elected and qualified. All the number of nominees named in this proposal.

Our Board, based on the recommendation of the independent members of the Board, has nominated each of Paul M. Galvin, Balan R. Ayyar, Yaniv Blumenfeld, Sean M. McAvoy, Christopher Melton, A. Richard Moore, Jr. and Mahesh S. Shetty to stand for election at the meeting. Each nominee hashave consented to bebeing named in this proxy statement and to serve as a director if elected. However,At the time of the 2020 Annual Meeting, if any nominee becomes unable to stand for election at the Annual Meeting, proxies will be voted in favor of the remainder of the nominees andnamed above is not available to serve as director (an event that the Board of Directors does not currently have any reason to anticipate), all proxies may be voted for substituteany one or more other persons that the Board of Directors designates in their place. It is the intention of the persons named as proxies to vote all shares of Common Stock for which they have been granted a proxy for the election of each of the nominees, unless our Board chooses to reduce the number of directors serving on the Board.

Each nominee, if elected, will be entitledeach to serve as a director until the 2019next annual meeting of stockholders and until ahis/her successor isshall have been duly elected and qualified.

The Board of Directors believes that each of the nominees is highly qualified or until his earlier death, resignation or removal.to serve as a member of the Board of Directors and each has contributed to the mix of skills, core competencies and qualifications of the Board of Directors. When evaluating candidates for election to the Board of Directors, the Nominating and Governance Committee and the Board of Directors seeks candidates with certain qualities that it believes are important, including experience, skills, expertise, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest, those criteria and qualifications described in each director’s biography below and such other relevant factors that the Nominating and Governance Committee considers appropriate in the context of the needs of the Board of Directors.

Director Nomination Process

Because we do not have a standing nominating committee, our independent directors evaluate

The Nominating and Governance Committee evaluates and recommend director nominees for the Board’s consideration. Each of the director nominees for the 2020 Annual Meeting was evaluated and recommended by the independent directorsNominating and Governance Committee and unanimously approved by the Board.Executive Committee of the Board of Directors.

Director Qualifications

The BoardNominating and Governance Committee has not established specific criteria or minimum qualifications that must be met by director nominees, but recognizes the value of nominating candidates who bring a variety of experiences, skills, perspectives and backgrounds to Board deliberations. The independent directors, when identifying nominees to serves as directors of the Company, consider each nominee’s qualifications, including educational, business and professional experience, such as real estate, manufacturing and finance, and whether such nominees will satisfy the independence standards under Nasdaq and SEC rules and regulations. We do not have a set policy or process for considering diversity in identifying nominees, but strive to identity and recruit nominees with a broad diversity of experience, talents, professions, backgrounds, perspective, age, gender, ethnicity and geographic representation,country of citizenship, and who possess the commitment necessary to make a significant contribution to the Company. Board nominees should be committed to enhancing long-term stockholder value and should possess high standards of integrity and ethical behavior. The independent directorsNominating and Governance Committee may also consider other elements as they deemit deems appropriate.

We believe that the continuing service of qualified incumbent directors promotes stability and continuity in the function of the Board of Directors, contributing to the Board’sBoard of Directors’ ability to work as a collective body, while giving us the benefit of the familiarity and insight into our affairs that our directors have accumulated during their tenure. Therefore, the independent directors will generally re-nominate incumbent directors who continue to be qualified for Board of Directors service and are willing to continue in such role. If an incumbent director is not standing for re-election or if a vacancy occurs between annual stockholder meetings, the Committee will seek out potential candidates for Board of Directors appointment who meet the criteria for selection as a nominee and have the specific qualities or skills being sought. Director candidates will be selected based upon input from the members of the Board of Directors, senior management of the Company and, if the Committee deems appropriate, a third-party search firm.

Stockholder Recommendations

We will also consider director candidates submitted in writing by stockholders. A stockholder who wishes to nominate a person for election must provide written notice to the Company in accordance with the procedures set forth in our bylaws. Among other requirements, such notification shall contain certain background information and the consent of each nominee to serve as one our directors, if elected. Stockholder nominations for election to the Board of Directors for the 20192021 annual meeting of stockholders must be made by written notification received by us no later than Tuesday, April 2, 2019.notification. See “Stockholder Proposals For the 2021 Annual Meeting.”

All potential director candidates will be evaluated in the same manner, regardless of the source of the recommendation.

4

6

2018INFORMATION ABOUT THE NOMINEES

2020 Nominees for Election as Directors

The following table sets forth the nominees to be elected at the 2020 Annual Meeting, each nominee’s age as of the Record Date, the year each nominee joined the Board of Directors and each nominee’s principal occupation:current position with the Company:

Name of Nominee | Age | Director Since |

| ||||||||

Paul M. Galvin |

| November 2011 | Chairman of the Board and Chief Executive Officer of the Company | ||||||||

| Yaniv Blumenfeld(1)(3)(4)(6) | 47 | April 2018 | Director | ||||||||

| 44 | ** | Nominee for Director |

|

|

| |||||

|

|

|

| ||||||||

|

|

|

| ||||||||

Christopher Melton(1)(2)(3)(4)(6)(7) |

| November 2011 |

| ||||||||

|

|

|

| ||||||||

|

|

|

|

____________

(1) Audit Committee Member.

| (1) | Audit Committee Member |

| (2) | Audit Committee Chairman |

| (3) | Compensation Committee Member |

| (4) | Nominating and Corporate Governance Committee Member |

| (5) | Nominating and Corporate Governance Committee Chairman |

| (6) | Executive Committee Member |

| (7) | Lead Independent Director |

(2) Audit Committee Chairman.

(3) Compensation Committee Member.

(4) Compensation Committee Chairman.

(5) Lead Independent Director

Mr. Kaufman, who currently serves on our Compensation Committee, has decided not to stand for re-election. Therefore, immediately after the Annual Meeting Mr. Kaufman will no longer be a member of the Board or any of its committees.

Paul M. Galvin was appointed as a director and the Company’s Chief Executive Officer upon consummation of the reverse merger among CDSI Holdings Inc., CDSI Merger Sub, Inc., the Company, and certain stockholders of the Company on November 4, 2011 (the “Merger”). Mr. Galvin is a founder of SG Blocks, LLC, the predecessor entity of the Company. He has served as the Chief Executive Officer of the Company and its predecessor entity since April 2009 and as a director of suchthe Company since January 2007. Mr. Galvin has been a managing member of TAG Partners, LLC (“TAG”), an investment partnership formed for the purpose of investing in the Company, since October 2007. Mr. Galvin brings over 20 years of experience developing and managing real estate, including residential condominiums, luxury sales and market rate and affordable rental projects. Prior to his involvement in real estate, he founded a non-profit organization that focused on public health, housing and child survival, where he served for over a decade in a leadership position. During that period, Mr. Galvin designed, developed and managed emergency food and shelter programs through New York City’s Human Resources Administration and other federal and state entities. From November 2005 to June 2007, Mr. Galvin was Chief Operating Officer of a subsidiary of Yucaipa Investments, where he worked with religious institutions that needed to monetize underperforming assets. While there, he designed and managed systems that produced highest and best use analyses for hundreds of religious assets and used them to acquire and re-develop properties across the U.S. Mr. Galvin has served on the board of directors of ToughBuilt Industries, Inc. (Nasdaq: TBLT), a designer, manufacturer and distributor of innovative tools and accessories to the building industry, since November 2018, and currently serves as the chair of its compensation committee and as a member of each of the audit and nominating and governance committees. Mr. Galvin holds a Bachelor of Science in Accounting from LeMoyne College and a Master’s Degree in Social Policy from Fordham University. He was formerly an adjunct professor at Fordham University’s Graduate School of Welfare. Mr. Galvin previously served for 10 years on the Sisters of Charity Healthcare System Advisory Board and six years on the Boardboard of SentiCare, Inc. In 2011, the Council of Churches of New York recognized Mr. Galvin with an Outstanding Business Leadership Award.

We selected Mr. Galvin’s pertinent experience, qualifications, attributesGalvin to serve on our Board of Directors as our Chairman because he brings to our Board of Directors extensive knowledge of the construction and skills includereal estate industries. During his managerial experience and the knowledge and experienceprofession career he has attained ingained vast knowledge of the construction and real estate industry.

Balan R. Ayyar was appointed as a director of the Company on January 30, 2017. General Ayyar is the founderindustries and CEO of Percipient.ai, a Silicon Valley advanced analytics firm providing artificial intelligence, machine learning and computer vision for U.S. national security missions since January 2017. In 2016, he was named the President and Chief Executive Officer of Sevatec, Inc., an IT solutions firm specializing in cyber, data science, cloud engineering and system integration across national security missions, where he had worked as the Chief Operating Officer since 2014. Before joining the private sector, General Ayyar served as the Commanding General of Combined Joined Interagency Task Force 435 in Kabul, Afghanistan, beginning in 2013. Priorbrings to that, General Ayyar led the U.S. Air Force Recruiting Service. He served in four combatant commands, as the military assistant to the Secretary of Defense, and as a White House Fellow. General Ayyar has received a number of awards and decorations

5

for his service, including a Bronze Star, an Air Force Commendation Medal and a Presidential Service Badge. He is a member of the Council on Foreign Relations and serves on the Board of Fairfax Futures, an early childhood education non-profit partnership. General Ayyar hasDirectors significant executive leadership and operational experience. His business and managerial experience provides him with a Bachelor of Science in international affairs from the U.S. Air Force Academy, Master’s degrees from Maxwell Air Force Base, Alabama, Auburn University and the Industrial Collegebroad understanding of the Armed Forces, National Defense University in Washington, D.C.operational, financial and strategic issues facing our Company.

General Ayyar’s pertinent experience, qualifications, attributes and skills include his extensive leadership experience and technology background.

7

Yaniv Blumenfeld joined the Board of Directors in April 2018. He founded Glacier Global Partners LLC in 2009 and is responsible for its strategic direction and oversees its investments and day-to-day management, including origination, underwriting, closing, investor relations and asset management functions. Mr. Blumenfeld has over 20 years of real estate experience, 13 years of which have been with leading Wall Street firms, where he was responsible for structuring, underwriting, pricing, securitizing and syndicating over $16 billion of commercial real estate loans and equity transactions. Prior to founding Glacier Global Partners LLC, Mr. Blumenfeld was a Managing Director at The Bear Stearns Companies, Inc. and JPMorgan Chase & Co., and, in such role, was responsible for structuring and closing over $2 billion in real estate debt and equity transactions for institutional clientele. Prior to that, Mr. Blumenfeld was a Managing Director and Head of the CMBS Capital Markets Group for the U.S. at EuroHypo AG, then world’s largest real estate investment bank. In that capacity, Mr. Blumenfeld expanded the large loan CMBS group and oversaw the structuring, pricing, securitization and syndication functions and served on the bank’s investment committee in charge of approving all transactions. He designed and implemented risk-control measures, standardized underwriting and pricing models and structured over $4 billion of real estate loans. Other positions previously held by Mr. Blumenfeld include Senior Vice President at Lehman Brothers, PaineWebber/UBS and Daiwa Securities. Prior to joining the banking industry, Mr. Blumenfeld worked as a real estate consultant at Ernst & Young real estate consulting group, advising real estate owners and operators, and various investment banks.

Mr. Blumenfeld received a Bachelor of Science in real estate finance from Cornell University School of Hotel Administration. He is a member of the CRE Finance Council, was a guest lecturer at Columbia University, and was a recipient of the Young Jewish Professional NYC Real Estate Entrepreneur & Achievement Award in 2013. He is also involved with various philanthropic organizations, including The American Israel Public Affairs Committee, White Plains Hospital, American Friends of Rabin Medical Center and is on the board of directors of ArtsWestchesterArts Westchester and the White Plains Business Improvement District.

We selected Mr. Blumenfeld to serve on our Board of Directors because he brings extensive knowledge of the real estate finance industry. Mr. Blumenfeld’s pertinent experience, qualifications, attributes and skills include his real estate finance, developments,risk-control, development, investment banking and capital raising.

Sean M. McAvoy was appointedMaggie Coleman is a Senior Managing Director and Co-Head of International Capital, Americas at Jones Lang LaSalle Incorporated (NYSE: JLL), a Fortune 500 company, a position she has held since January 2020. In this role, Ms. Coleman leads a team that is primarily focused on cross-border capital deployment from global investors across Canada, EMEA and Asia Pacific. Ms. Coleman is responsible for placing capital from international investors into JLL’s direct transactions, structuring recapitalizations and joint ventures, while also helping offshore capital acquire and finance JLL’s global investment portfolios and large single asset sales. Ms. Coleman has been involved in over $20 billion in transactions and has directed the JLL platform that has executed over $53 billion in transactions since 2011, including over $10 billion in loan sales in the US, Europe and Asia. Further, Ms. Coleman is responsible for business development, client management and the execution of global transactions and is a frequent speaker on global capital flows in the real estate sector. Ms. Coleman also served in various other positions at JLL including as Executive Vice President at JLL form 2013-209 and Managing Director for, 2016-2019. Prior to the its merger with JLL in 2008, Ms. Coleman worked as a directorDirector within the M&A Advisory Services group of Staubach Capital Markets specializing in real estate structured financial solutions and investment banking. Ms. Coleman earned a master’s degree from the University of Chicago in Political Economy and a bachelor’s degree in business economics & public policy (BEPP) and international business from Indiana University’s Kelley School of Business. Ms. Coleman is a council member of the Company on July 1, 2016 by HCI. SeanUrban Development/Mixed-Use Council (UDMUC) at the Urban Land Institute. Commercial Property Executive named Ms. Coleman as a recipient of the “Rising Leader Award” for 2012. In 2012, Ms. Coleman also received the Catalyst Award from JLL for her achievements in team management. Ms. Coleman is a founding memberaffiliated with the Guild Board of HCM, founded in 2010. He has over 20 yearsthe Boys & Girls Clubs of experience in structuringChicago and negotiating transactions, primarily in the public markets. Between 1996 and 2008, Mr. McAvoy wasis a member of the mergers and acquisitions, private equity, and corporate finance practices at Jones Day, an international law firm, where he served as a founding partnerBoard of Directors of the firm’s Silicon Valley office from 2002Jackson Chance Foundation.

We selected Ms. Coleman to 2008. At Jones Day, Mr. McAvoy represented public companiesserve on our Board because she brings extensive knowledge of finance and their boards of directors, as well as financial sponsors, in domestic and cross-border mergers and acquisitions, auctioned dispositions, unsolicited and negotiated tender offers, leveraged buyouts, including going-private transactions, and leveraged recapitalizations. Mr. McAvoy also counseled boards of directors and senior management regarding corporate governance, fiduciary duty, takeover preparedness, and disclosure obligations. Prior to his corporate legal career, Mr. McAvoy served as a legislative aide to Senator William S. Cohen and as a Professional Staff Member of the U.S. Senate Governmental Affairs Committee. Mr. McAvoy also served as a special counsel and senior staff member on Senator John McCain’s 2008 presidential campaign. Currently, Mr. McAvoy serves on the board of The Orvis Company, Inc., a specialty retailer and sporting goods company, and on the board of the Pacific Research Institute, a California-based free-market think tank. Mr. McAvoy is an honors graduate of Williams College and earned advanced degrees at the London School of Economics and Political Science, where he was an Alumni and Friends of the London School of Economics Scholar, and Georgetown University Law School.

Mr. McAvoy’sreal estate industry. Ms. Coleman’s pertinent experience, qualifications, attributes and skills include financial literacy and expertise, inmanagerial experience and the knowledge and experience she has attained through her global capital finance strategy and corporate law.activities.

6

Christopher Melton was appointed as a director of the Company upon consummation of the Merger on November 4, 2011. Mr. Melton is Principala licensed real estate salesperson in the State of South Carolina and co-founderuntil June 2019 was a principal of Callegro Investments. Callegro Investments, isLLC, a specialist land investor investing in the southeastern U.S., which he founded 2012. Since June 2019, he has served as a specialist Land Advisor with SVN. Mr. Melton also serves on several public and private boards, including Jupiter Wellness, Inc. since August 2019, and has served on the Board of World Educationsince February 2018 as chief investment officer and Development Fund,analyst at TNT Capital Advisors, a non-profit organization that focuses on education for underprivileged childrencapital advisory firm based in Latin America, since 2008.Florida. He also served as a sales agent as MSK Commercial Services, a commercial real estate company, from February 2018 to June 2019. From 2000 to 2008, Mr. Melton was a Portfolio Manager for Kingdon Capital Management (“Kingdon”) in New York City, where he ran an $800 million book in media, telecom and Japanese investment. Mr. Melton opened Kingdon’s office in Japan, where he set up a Japanese research company. From 1997 to 2000, Mr. Melton served as a Vice President at JPMorgan Investment Management as an equity research analyst, where he helped manage $500 million in REIT funds under management. Mr. Melton was a Senior Real Estate Equity Analyst at RREEF Funds in Chicago from 1995 to 1997. RREEF Funds is the real estate investment management business of Deutsche Bank’s Asset Management division. Mr. Melton earned a Bachelor of Arts in Political Economy of Industrial Societies from the University of California, Berkeley in 1995. Mr. Melton earned Certification from University of California, Los Angeles’s Anderson Director Education Program in 2014.

We selected Mr. Melton to serve on our Board of Directors because he brings extensive knowledge of finance and the real estate industry. Mr. Melton’s pertinent experience, qualifications, attributes and skills include financial literacy and expertise, managerial experience and the knowledge and experience he has attained through his real estate investment and development activities.

A. Richard Moore, Jr. joined the Board on February 2, 2017, and has served as Lead Independent Director since his appointment by the Board in April 2018. Mr. Moore is an independent management consultant. From February 2013 through September 2016, he was managing director for non-bank activities of Strategic Growth Bank Incorporated (“Strategic Growth”) in El Paso, Texas, focusing on Strategic Growth’s mortgage activities and new business initiatives. From November 2004 through December 2012, prior to joining Strategic Growth, Mr. Moore held various positions with Verde Realty, a Maryland REIT with headquarters in El Paso and Houston, including Executive Vice President, Chief Financial Officer and Corporate Secretary. Prior to that, Mr. Moore spent 16 years in the Real Estate Department of the Investment Banking Division of Goldman, Sachs & Co., where he developed and led the firm’s sale/leaseback business and later headed the firm’s REIT banking activities. Mr. Moore has been a guest lecturer on real estate finance and the REIT structure at Columbia University, New York University, and Southern Methodist University. He served as director and chairman of the Audit Committee of Guardian Mortgage Company, Inc., in Dallas, Texas, until May 2016. He is currently an advisory trustee of Borderplex Realty Trust, including serving on its compensation committee. He is also a director and chairman of the Investment Committee for the Paso del Norte Health Foundation and a director of the Paso del Norte Charitable Foundation. Mr. Moore holds a B.A. and Master of Divinity from Southern Methodist University and a Master of Business Administration from the Harvard Business School.

Mr. Moore’s pertinent experience, qualifications, attributes and skills include his extensive background in real estate development and financial expertise.

8

Mahesh S. Shetty has served as a director of the Company since July 1, 2016 and has served as the Company’s Chief Financial Officer and President since July 29, 2016 and February 1, 2018, respectively. From December 2015 to June 2017, Mr. Shetty served as the Chief Restructuring Officer and Principal Financial Officer for PFO Global, Inc., an innovative manufacturer and commercial provider of advanced prescription lenses. From 2008 to 2015, Mr. Shetty served as the Partner, Chief Operating Officer and Chief Financial Officer at Encore Enterprises, a private real estate investment firm with over $750 million in assets. He had management oversight and responsibility for all of Encore Enterprise’s finance, risk management, human resources and technology. Prior to joining Encore Enterprises, Mr. Shetty was the Chief Financial Officer of North American Technologies Group, Inc., a Nasdaq-listed manufacturing company focused on the transportation industry. Mr. Shetty began his career at PricewaterhouseCoopers LLP and has served in executive finance and operational leadership roles with Fortune 500 and mid-size private and public companies in the manufacturing, technology and service industries. He earned a bachelor’s degree majoring in banking, economics and accounting and a French minor from Osmania University, India and received his Master of Business Administration, summa cum laude, from the University of Texas at Dallas. He is a Certified Public Accountant, a Certified Information Technology Professional, a Chartered Global Management Accountant and a Fellow Chartered Accountant. Mr. Shetty serves on the board and is the treasurer of Mothers Against Drunk Driving and on the National Board of Financial Executives International; he previously served as chairman of the U.S. India Chamber of Commerce, Dallas-Fort Worth. He also serves on the board of EZlytix, a private cloud-based business intelligence software company, and on the board of BIG Logistics, a private logistics company.

7

Mr. Shetty’s pertinent experience, qualifications, attributes and skills include expertise in finance, strategy, technology and operations.

On October 15, 2015, the Company and its subsidiaries filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Southern District of New York. At that time, each of Messrs. Galvin and Melton served as a director of the Company and continued to serve as such after the Company’s emergence from bankruptcy on June 30, 2016.

Vote Required

The affirmative vote of a plurality of the votes cast, either in person or by proxy, at the Annual Meeting is required for the election of these nominees as directors. You may vote “FOR” or “WITHHOLD” authority to vote for each of the nominees for director. If you “WITHHOLD” authority to vote with respect to one or more nominees, such vote will have no effect on the election for such nominees.Broker non-votes, if any, will have no effect on the outcome of the vote as long as each nominee receives at least one FOR vote. Shares represented by properly executed proxies will be voted, if specific instructions are not otherwise given, in favor of each nominee.

THE BOARD UNANIMOUSLYOF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF THE NOMINEES LISTED ABOVE AS DIRECTORS.

8

Stockholder Communications with Directors

The Board of Directors has established a process to receive communications from stockholders. Stockholders may contact any member or all members of the Board of Directors, any Board committee, or any chair of any such committee by mail. To communicate with the Board of Directors, any individual director or any group or committee of directors, correspondence should be addressed to the Board of Directors or any such individual director or group or committee of directors by either name or title. All such correspondence should be sent “c/o Corporate Secretary” at SG Blocks, Inc., 195 Montague Street, 14th Floor, Brooklyn, New York 11201.

All communications received as set forth in the preceding paragraph will be opened by the office of our Secretary and the Corporate Secretary’s office will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope or e-mail is addressed. The Board of Directors has instructed the Corporate Secretary to forward stockholder correspondence only to the intended recipients, and has also instructed the Corporate Secretary to review all stockholder correspondence and, in the Corporate Secretary’s discretion, refrain from forwarding any items deemed to be of a commercial or frivolous nature or otherwise inappropriate for the Board of Directors’ consideration. Any such items may be forwarded elsewhere in our company for review and possible response.

THE BOARD OF DIRECTORS AND ITS COMMITTEES

Board Leadership Structure

The Board of Directors recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. Our Board of Directors is currently led by a Chairman of the Board of Directors who also serves as our Chief Executive Officer. The Board of Directors understands that the right Board leadership structure may vary depending on the circumstances, and our independent directors periodically assess these roles and the Board of Directors leadership to ensure the leadership structure best serves the interests of the Company and stockholders.

Mr. Galvin currently holds the Chairman and Chief Executive Officer roles. In addition, in February 2018, members of the Board agreed to appoint a Lead Independent Director. In April 2018, the Board, upon the recommendation of the independent directors, createdMr. Melton currently serves as the Lead Independent Director position and appointed Mr. Moore to such role.elected by the majority of the Board of Directors.

The responsibilities of the Lead Independent Director include, among others,others: (i) serving as primary intermediary between non-employee directors and management; (ii) approving the agenda and meeting schedules for the Board;Board of Directors; (iii) advising the Chairman of the Board of Directors as to the quality, quantity and timeliness of the information submitted by management to directors; (iv) recommending todirector candidates and selections for the Chairmanmembership and chairman position for each committee of the Board the retention of advisors and consultants who report directly to the Board;Directors; (v) calling meetings of independent directors; and (vi) serving as liaison for consultation and communication with stockholders.

We believe the current leadership structure, with combined Chairman and Chief Executive Officer withroles and a Lead Independent Director, leadership structure best serves the Company and its stockholders at this time. Mr. Galvin possesses detailed and in-depth knowledge of the Company and the industry and the issues, opportunities and challenges we face, and is best positioned to ensure the most critical business issues are brought for consideration by the Board.Board of Directors. In addition, having one leader serving as both the Chairman and Chief Executive Officer provides decisive, consistent and effective leadership, as well as clear accountability to our stockholders and customers. This enhances our ability to communicate our message and strategy clearly and consistently to our stockholders, employees, customers and suppliers, particularly during times of turbulent economic and industry conditions. The Board of Directors believes the appointment of a strong Lead Independent Director and the use of regular executive sessions of the non-management directors, along with a majority the Board of Directors being composed of independent directors, which, if the director nominees included herein are elected, will be the case following the Annual Meeting, allow it to maintain effective oversight of management.

We believe that the combination of the Chairman and Chief Executive Officer roles is appropriate in the current circumstances and, based on the relevant facts and circumstances, separation of these offices would not serve our best interests and the best interests of our stockholders at this time.

9

Director Independence

Nasdaq Listing Rule 5605 requires a majority of a listed company’s board to be comprised of independent directors. In connection with our June 2017 public offering, we are relying on the one-year phase-in period for such requirement. In addition, the Nasdaq Listing Rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and compensationnominating and governance committees be independent under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Members of the Audit committee membersCommittee and compensation committee membersCompensation Committee must also satisfy the independence criteria set forth in Rules 10A-3 and 10C-1 under the Exchange Act, respectively. Under Nasdaq Listing Rule 5605(a)(2), a director will only qualify as an “independent director” if, in the opinion of the Board of Directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In order to be considered independent for purposes of Exchange Act Rule 10A-3, an Audit Committee member may not, other than in his or her capacity as a member of the Audit Committee, the Board of Directors or any other committee of the Board of Directors, accept, directly or indirectly, any consulting, advisory or other compensatory fee from the Company or any of its subsidiaries, or otherwise be affiliated with the Company or any of its subsidiaries. In order for Compensation Committee members to be considered independent for purposes of Exchange Act Rule 10C-1, the Board of Directors must consider all factors specifically relevant to determining whether a director has a relationship to the Company that is material to that director’s ability to be independent from management in connection with the duties of a Compensation Committee member, including, but not limited to: (1) the source of

9

compensation of the director, including any consulting advisory or other compensatory fee paid by the Company to the director; and (2) whether the director is affiliated with the Company or any of its subsidiaries or affiliates.